Mumbai – The income tax return (ITR) filing season for Financial Year 2024–25 (Assessment Year 2025–26) officially began on April 1, 2025, and taxpayers are urged to file their returns before the deadline of July 31, 2025, to avoid late penalties and other complications.

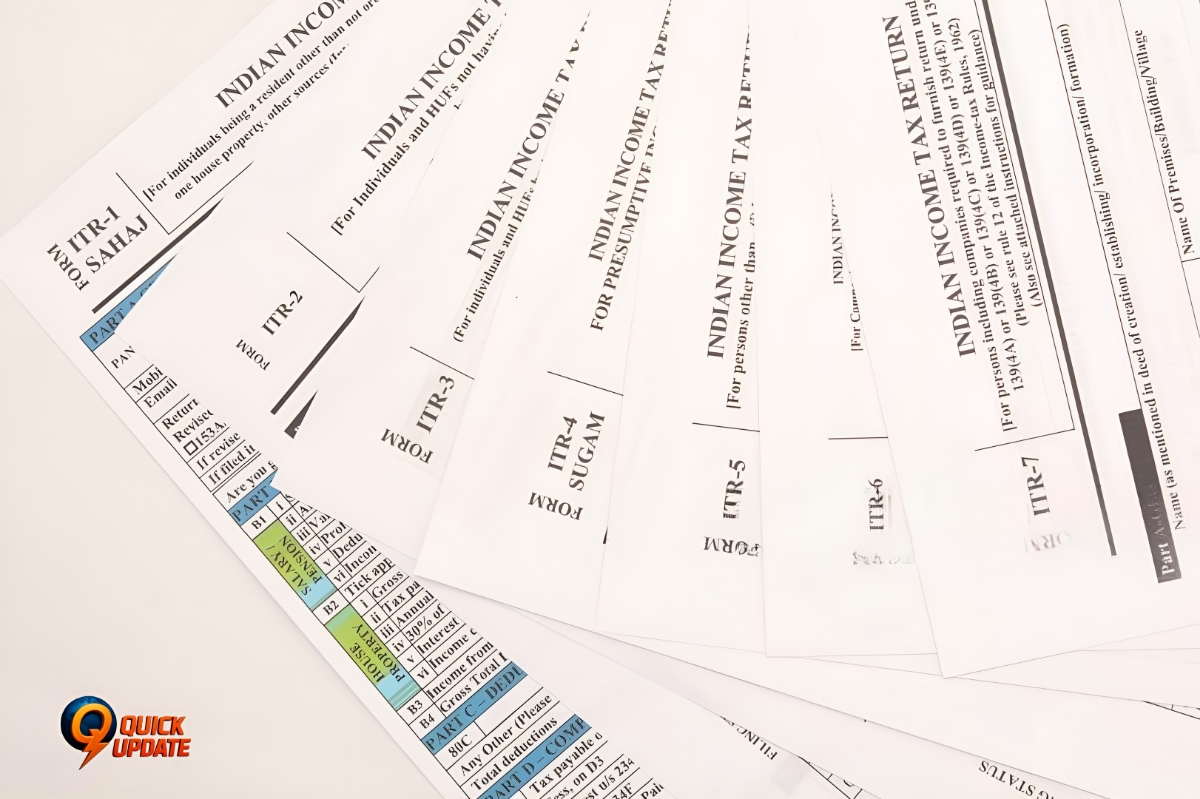

The Income Tax Department has released all ITR forms ranging from ITR-1 to ITR-7, each tailored to specific taxpayer categories. Choosing the correct ITR form is crucial for smooth processing and to prevent return rejection by the system.

🔍 Which ITR Form Should You File?

👤 ITR Forms for Individual Taxpayers

These apply to salaried employees, freelancers, and professionals.

| Form | Who Should Use It |

|---|---|

| ITR-1 (Sahaj) | Salaried individuals earning up to ₹50 lakh |

| ITR-2 | Individuals with capital gains, foreign income, or owning multiple properties |

| ITR-3 | Professionals or those with business income |

| ITR-4 (Sugam) | Individuals using the presumptive taxation scheme under Sections 44AD, 44ADA, or 44AE |

🧬 ITR Forms for Hindu Undivided Families (HUFs)

HUFs are taxed similarly to individuals and can file ITR-2, ITR-3, or ITR-4, depending on their income sources.

🏢 ITR for Companies

Private and public companies, excluding those claiming exemption under Section 11, must file using ITR-6. Corporate tax applies, with MAT (Minimum Alternate Tax) applicable in some cases.

👥 ITR for Firms & LLPs

Firms and LLPs pay a flat tax of 30% plus cess/surcharge. They must file ITR-5.

🧾 ITR for AOPs/BOIs (Association of Persons / Body of Individuals)

These entities should also use ITR-5, with taxation based on either individual slab rates or the maximum marginal rate.

🏛️ ITR for Local Authorities

Local government bodies like municipalities and panchayats use ITR-5 to declare taxable income from commercial operations.

🏫 ITR for Artificial Juridical Persons (AJPs)

These include charitable trusts and societies not fitting other categories.

| Form | Use Case |

|---|---|

| ITR-5 | For general AJPs |

| ITR-7 | For AJPs claiming exemption under Sections 11 and 12 |

Also Read: FY 2024-25. Start ITR filing now! Last Deadline

⚠️ Why Correct ITR Form Selection Matters

Using the wrong ITR form may lead to return rejection, processing delays, or notices from the IT Department. Filing with the correct form ensures faster processing, accurate tax computation, and smooth refund credits.

📌 Summary

-

The ITR filing deadline is July 31, 2025.

-

The correct form depends on your income type and entity structure.

-

Errors in form selection may lead to return rejection or penalties.

-

File early to avoid last-minute glitches and penalties.