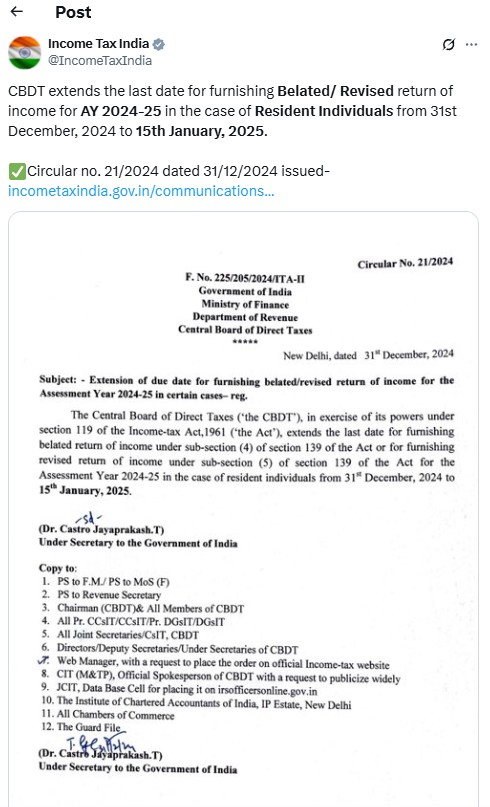

New Delhi, January 15, 2025 – The final deadline for filing your Income Tax Return (ITR) for the Assessment Year 2024–25 is today – January 15, 2025. This belated deadline came into effect after two prior extensions, following legal intervention. The original due date was July 31, 2024, followed by a second deadline on December 31, 2024.

📅 Final ITR Deadline After Extensions

The initial ITR deadline was set as July 31, 2024. However, due to system glitches and a public interest litigation in the Bombay High Court, the government granted interim relief and extended the deadline—first to December 31, 2024, and now finally to January 15, 2025.

Today is the last opportunity for taxpayers to file their ITR for FY 2023–24 (AY 2024–25). There are no indications of further extensions.

💰 Do You Have to Pay More Now?

Yes. If you are filing your ITR after July 31, 2024, you are liable to pay a late fee under Section 234F of the Income Tax Act:

-

💵 Income up to ₹5 lakh – Late fee of ₹1,000

-

💵 Income above ₹5 lakh – Late fee of ₹5,000

These charges are in addition to any tax payable and cannot be waived.

Also Read: Choose the Correct ITR Form – Click Here

⚠️ What Happens If You Miss This Final Deadline?

Failing to file your ITR even by January 15, 2025, can lead to serious consequences:

📩 1. Notices from Income Tax Department

You may receive a notice or demand for non-compliance and failure to file under Section 142(1) or Section 148.

❌ 2. No Option to Revise Returns

If you don’t file the return today, you lose the ability to revise or correct your ITR later.

🚫 3. No Carry Forward of Losses

You won’t be able to carry forward capital or business losses to future years, which can impact future tax savings.

💼 4. Penalty or Prosecution

Chronic defaulters may face additional penalties, interest on unpaid tax, or even prosecution in extreme cases.

✅ Key Takeaways

-

📌 Final ITR filing date: January 15, 2025

-

🧾 Late fees apply if filing after July 31, 2024

-

⛔ Missed deadline = No revision + Possible notice/penalty

-

🕒 File before midnight to avoid legal and financial trouble