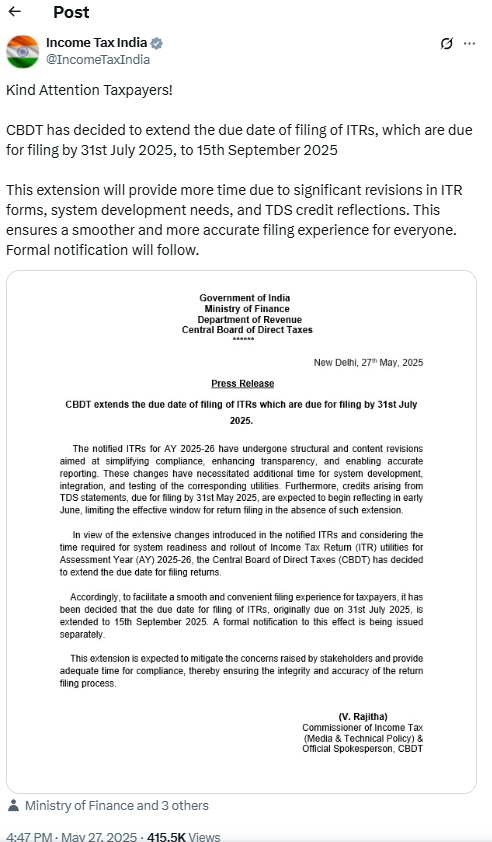

In a significant development for Indian taxpayers, the Income Tax Department has extended the ITR filing last date for FY 2024-25 (AY 2025-26) from July 31, 2025, to September 15, 2025. This extension, officially announced by the Central Board of Direct Taxes (CBDT) via a post on X (formerly Twitter), provides much-needed relief to millions of salaried individuals and non-auditable taxpayers.

Why Was the ITR Filing Last Date Extended?

According to the Income Tax Department, this decision stems from delays in the release of the Income Tax Return (ITR) forms and the unavailability of filing utilities on the income tax portal. The CBDT cited the following reasons for the extension:

-

Significant revisions in ITR forms that demand extra development and testing time.

-

Delay in TDS credits being reflected, which is critical for accurate return filing.

-

Feedback from taxpayers and stakeholders, highlighting concerns over the compressed timeline.

Official Statement from the CBDT

“CBDT has decided to extend the due date of filing of ITRs, which are due for filing by 31st July 2025, to 15th September 2025. This extension ensures a smoother and more accurate filing experience for everyone,” the CBDT announced on social media.

Salaried Employees to Benefit from the Extension

The ITR filing deadline of July 31 typically applies to most salaried employees and individuals whose accounts do not require auditing. With the new deadline of September 15, 2025, salaried individuals get an additional 46 days to file their returns.

However, a late filing penalty of up to ₹5,000 will still be applicable if the ITR is not filed by the revised due date

What Tax Experts Are Saying

Naveen Wadhwa, Chartered Accountant & VP – Taxmann.com

“This extension avoids potential legal actions and provides breathing room to taxpayers. The ITR forms were released in batches with delays up to 39 days.”

Deepak Kumar Jain, CEO – TaxManager.in

“With over 10 crore expected filers for AY 2025-26, including many first-time users, the extension is necessary. It supports smoother reconciliation of TDS and accurate returns.”

Ashish Niraj, CA at A S N & Company

“Even on May 27, 2025, the ITR filing feature is not fully functional on the portal. This extension benefits both professionals and individuals.”

CA Deepak Chopra, Chairman, KSCAA

“Without the ITR utilities, online filing was nearly impossible. The CBDT’s move echoes previous high court rulings favoring early utility releases.”

CA Tarun Kumar Madaan

“Major revisions in forms, such as Schedule-Capital Gains, necessitated this change. Also, the timing of TDS credit visibility would have made July 31st filing impractical.”

Key Highlights of the Extension

| Feature | Details |

|---|---|

| Previous Deadline | July 31, 2025 |

| New Deadline | September 15, 2025 |

| Reason | Delay in ITR forms & utility release |

| Affected Taxpayers | Salaried, non-audit cases |

| Penalty | ₹5,000 if not filed by revised due date |

| Benefit | More time for accurate filing |

Summary: What You Should Do Now

-

Wait for utility release: The ITR utilities will be available soon on the Income Tax e-filing portal.

-

Check Form 26AS and AIS: Ensure your TDS and income details are correct.

-

Start documentation early: Use this extension to gather necessary financial documents.

-

Avoid last-minute filing: Though extended, don’t wait till the last moment to file your ITR.

- Simple Steps to File Your Income Tax Return Without Mistakes Click Here

Stay Updated with Reliable Tax News

For more updates on ITR filing last date extensions, CBDT notifications, and tax-saving tips, follow thequickupdate.com. We bring you the latest verified information to help you stay compliant and stress-free.

Simple Steps to File Your Income Tax Return Without Mistakes Click Here

You could definitely see your skills within the work you write. The world hopes for even more passionate writers like you who are not afraid to mention how they believe. At all times follow your heart.

Thanks for making me to gain new suggestions about computer systems. I also hold the belief that certain of the best ways to help keep your notebook computer in primary condition is by using a hard plastic case, as well as shell, that fits over the top of one’s computer. These kind of protective gear usually are model distinct since they are made to fit perfectly in the natural outer shell. You can buy all of them directly from the seller, or via third party places if they are for your notebook computer, however not all laptop can have a covering on the market. Once again, thanks for your suggestions.

I don抰 even know the way I ended up right here, however I thought this publish was great. I don’t know who you are but definitely you’re going to a well-known blogger when you are not already 😉 Cheers!

I’ve been absent for some time, but now I remember why I used to love this site. Thanks , I抣l try and check back more frequently. How frequently you update your website?

I believe this is one of the so much important info for me. And i’m happy studying your article. However should remark on few basic things, The web site style is ideal, the articles is actually nice : D. Excellent task, cheers

Great post. I was checking constantly this blog and I’m impressed! Extremely useful info specially the last part 🙂 I care for such information a lot. I was looking for this particular information for a long time. Thank you and best of luck.