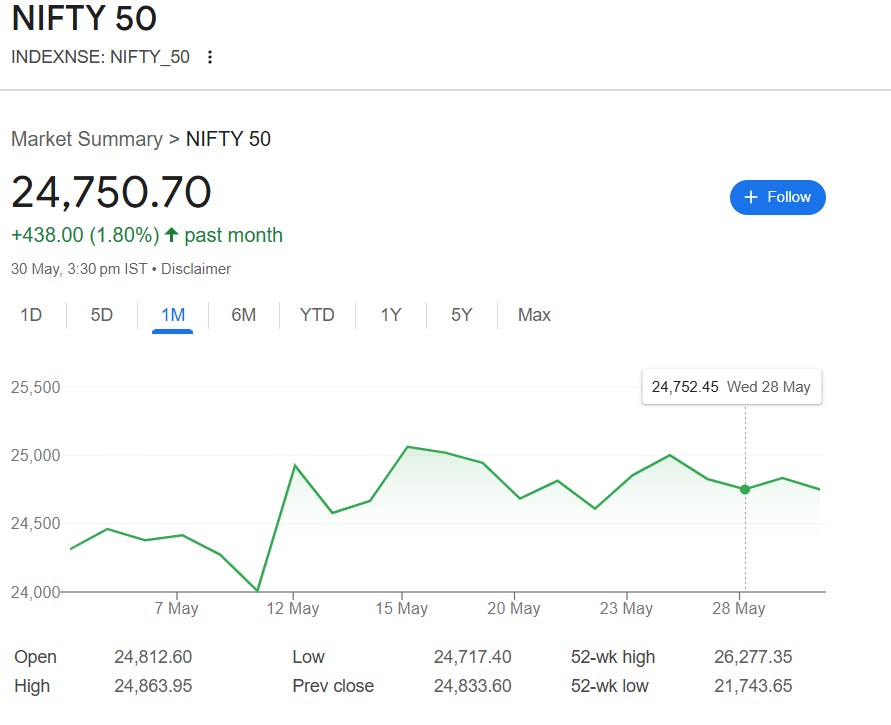

New Delhi, June 2, 2025 — The Indian stock market ended last week on a mixed note as indices showed signs of consolidation ahead of major domestic and global triggers. While the Nifty 50 closed the week slightly lower at 24,750.70, the Bank Nifty ended 0.6% higher at 55,749.70, highlighting sectoral divergence. Midcap and smallcap indices outperformed, gaining nearly 1.5% each.

As the new trading week kicks off on Monday, June 2, investors will watch out for key support and resistance levels and fresh trading ideas from top market analysts.

🔍 Nifty 50 & Bank Nifty: Technical Outlook

According to Amol Athawale, VP – Technical Research, Kotak Securities:

-

📉 Nifty 50: Key support lies at 24,650, with resistance around 25,000. A sideways market may persist unless a breakout occurs in either direction.

-

📈 Bank Nifty: Immediate support is placed at 55,000, and the index may trend higher toward the 56,500–57,000 zone if it stays above this level.

🌐 Global Cues to Watch

As per Ajit Mishra, SVP – Research, Religare Broking:

-

The RBI Monetary Policy Committee (MPC) meeting on June 6 will be a key domestic event.

-

Market participants will also monitor:

-

Auto sales data and high-frequency economic indicators.

-

Monsoon progress.

-

Trends in FII flows.

-

Global developments, particularly in the US bond market and trade negotiations.

-

📊 Eight Stocks to Buy or Sell on Monday – June 2, 2025

Here are expert stock picks for Monday from analysts at Choice Broking, Anand Rathi, and Prabhudas Lilladher.

🟩 Picks by Sumeet Bagadia (Choice Broking)

-

Welspun Corp Ltd (WELCORP)

-

📌 Buy @ ₹935.55 | 🎯 Target: ₹975 | ❗ Stop-loss: ₹900

-

Reason: Strong bullish trend with higher highs/lows and price above all major EMAs. A breakout above ₹938.80 could trigger more upside.

-

-

Authum Investment & Infrastructure Ltd (AIIL)

-

📌 Buy @ ₹2,379.20 | 🎯 Target: ₹2,545 | ❗ Stop-loss: ₹2,295

-

Reason: Near all-time high of ₹2,386; EMAs indicate consistent upward momentum.

-

🟩 Picks by Ganesh Dongre (Anand Rathi)

-

Hindustan Aeronautics Ltd (HAL)

-

📌 Buy @ ₹4,975 | 🎯 Target: ₹5,100 | ❗ Stop-loss: ₹4,900

-

Reason: Strong bullish trend above critical support zone. Good risk-reward setup.

-

Punjab National Bank (PNB)

-

📌 Buy @ ₹105 | 🎯 Target: ₹112 | ❗ Stop-loss: ₹100

-

Reason: Continues upward trend with solid support at ₹100. Positive short-term technicals.

-

-

Dr Reddy’s Laboratories Ltd (DRREDDY)

-

📌 Buy @ ₹1,251 | 🎯 Target: ₹1,470 | ❗ Stop-loss: ₹1,420

-

Note: Likely a typo in the source; DRREDDY price is likely above ₹5,000. Please verify.

-

Reason: Bullish reversal pattern with short-term potential.

-

-

📌 Key Takeaways for Monday

-

📍 Nifty range: 24,650–25,000 – Watch for breakouts.

-

📍 Bank Nifty support: 55,000 – Positive bias if above this level.

-

📍 Keep an eye on global bond yields, RBI policy, and FII flows.

-

📈 Stock-specific opportunities remain robust across midcaps and PSU banks.

🔖 Disclaimer:

The stock recommendations mentioned above are based on technical analysis from individual brokerage firms. www.thequickupdate.com does not endorse any of these calls. Always consult a SEBI-registered financial advisor before investing.