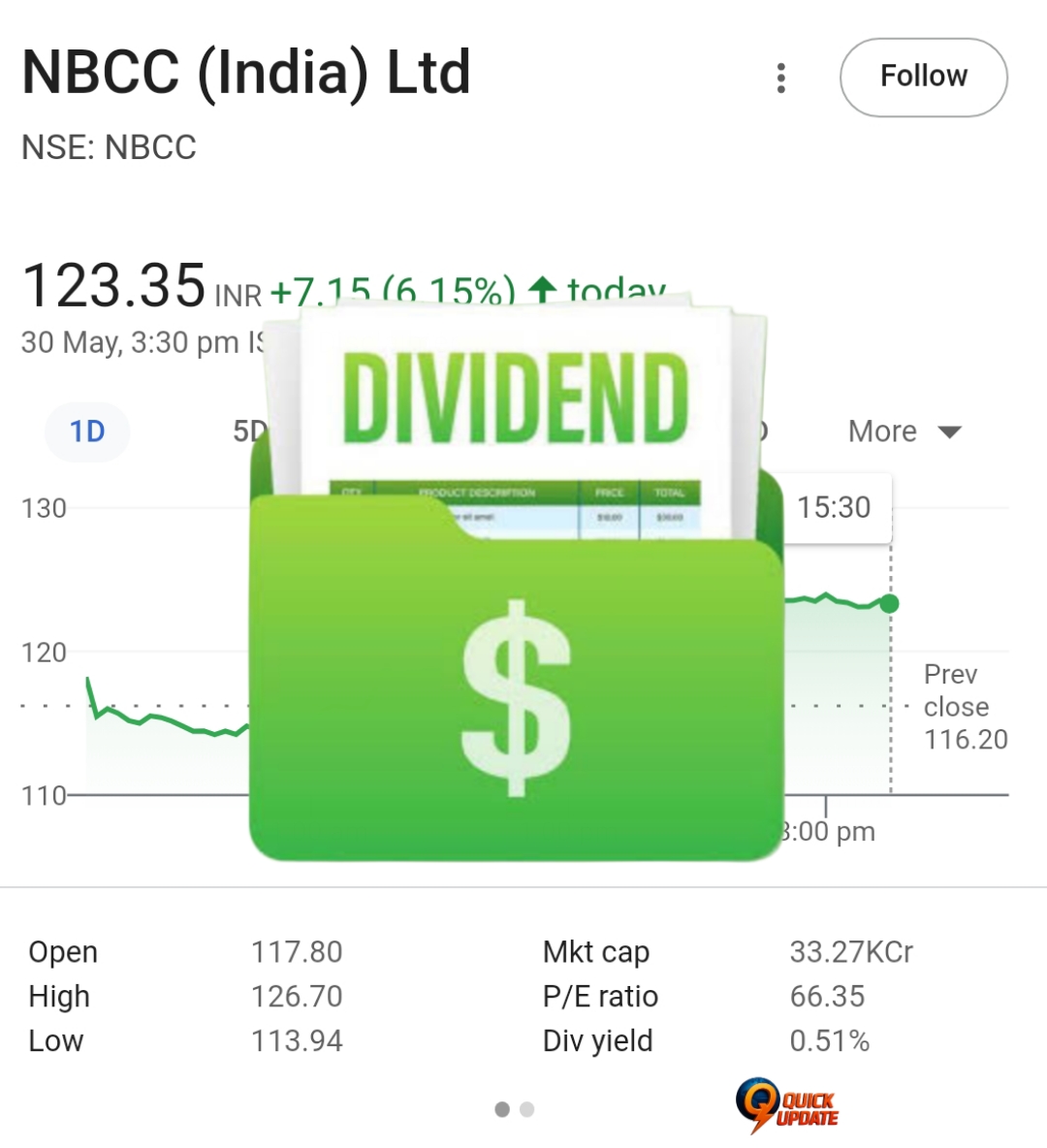

NBCC (India) Ltd., a Navratna Central Public Sector Enterprise under the Ministry of Housing and Urban Affairs, has announced a final dividend for the financial year 2024–25. The announcement came after the company’s Board of Directors met on May 29, 2025, and approved the proposal. The final dividend is now pending approval by shareholders during the upcoming Annual General Meeting (AGM).

🏦 Final Dividend Details

NBCC’s board has proposed a final dividend of ₹0.14 per equity share, each having a face value of ₹1, for FY 2024–25. This is in addition to the interim dividend of ₹0.53 per share that was declared earlier on February 4, 2025, bringing the total dividend for the fiscal year to ₹0.67 per share.

📅 Payment Timeline

As per regulatory guidelines, once the dividend is approved by shareholders at the AGM, it will be disbursed within 30 days from the declaration date. The company has not yet released the record date, which determines shareholder eligibility for the final dividend.

📃 Regulatory Compliance

NBCC confirmed that this announcement complies with Regulation 30 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015. The company disclosed the dividend proposal and financial performance details as part of its mandatory stock exchange filings.

📊 Q4 & FY25 Financial Performance

During the same board meeting, NBCC also released its financial results for the fourth quarter and the full year ending March 31, 2025.

- Consolidated Net Profit (Q4 FY25): ₹176 crore — a 29.3% increase year-on-year (YoY) compared to ₹136 crore in Q4 FY24.

- Revenue: ₹4,643 crore — up 16.2% YoY from ₹3,996 crore.

- EBITDA: ₹290 crore — an improvement of 19.4% from ₹243 crore in the corresponding quarter last year.

These numbers reflect the company’s strong operational performance and effective project execution, particularly in public infrastructure and real estate segments.

📈 Market Reaction

As of 10:06 AM on May 30, 2025, NBCC shares were trading at ₹114.49 apiece on the NSE, down by 1.47%, underperforming the Nifty 50, which was down 0.20% at the time.