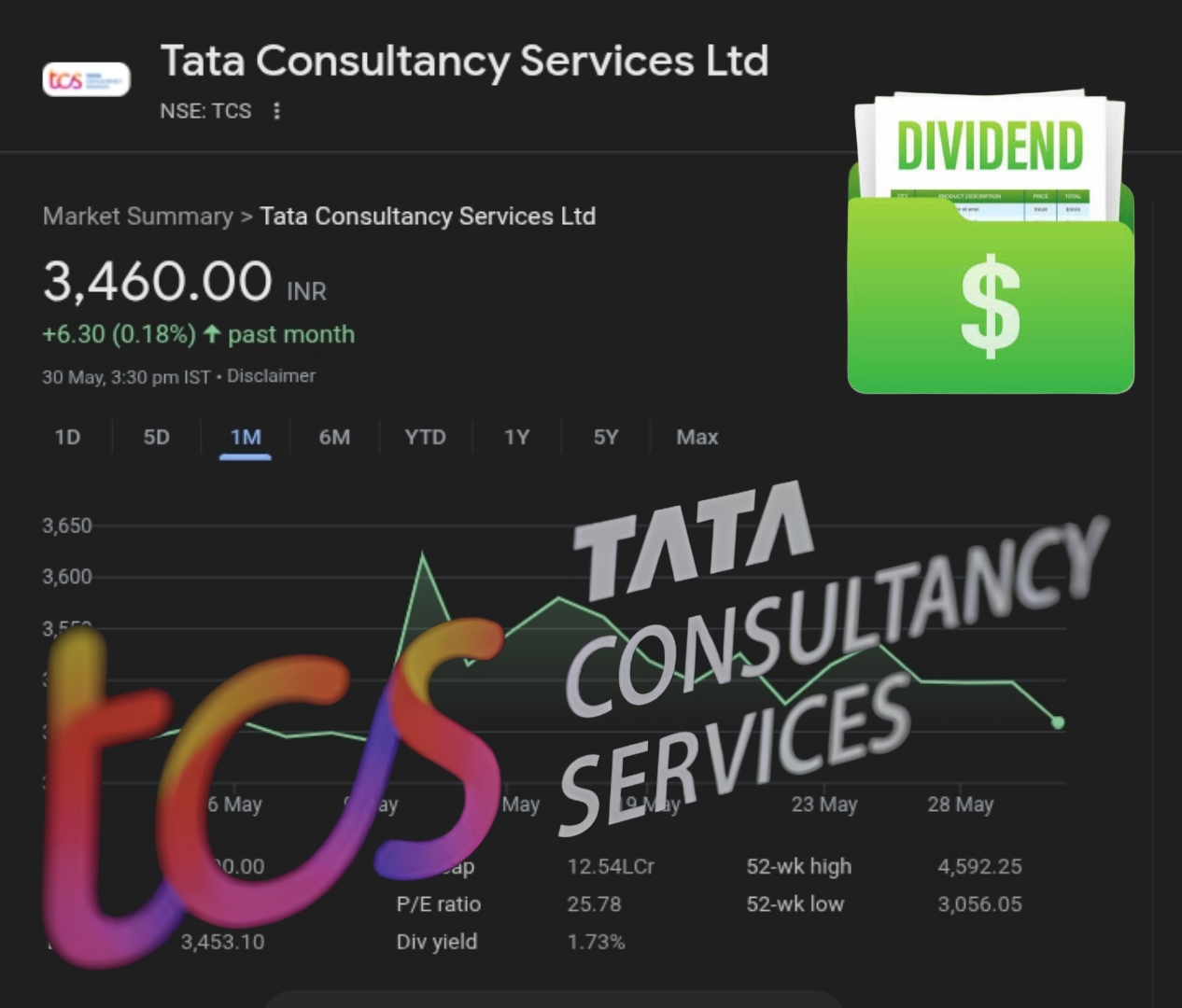

Mumbai, May 30, 2025 – Tata Sons, the principal investment holding company of the Tata Group, is expected to witness a substantial 86% increase in its dividend income from Tata Consultancy Services (TCS) in the financial year 2024–25 (FY25), reaching an estimated ₹37,212 crore.

The board of Tata Sons is scheduled to meet this Thursday to finalize its audited financial statements for FY25. Despite this significant jump in dividend receipts from TCS and other group entities, Tata Sons is projected to report flat revenues compared to FY24.

💰 TCS Drives Tata Sons’ Earnings Surge

During FY25, TCS declared a total dividend of ₹130 per share, which resulted in a whopping ₹37,212 crore payout to Tata Sons. This marks a 17.5% increase in income from TCS compared to FY24, which included dividends and buyback proceeds.

While dividend income surged, there were minimal share buybacks during the fiscal year, contributing to the plateau in overall revenue growth for the holding company.

📊 Tata Sons FY24 Performance Recap

In the previous fiscal (FY24), Tata Sons had posted a total income of ₹43,893 crore. This included:

- ₹21,528.94 crore from dividend income.

- ₹20,036 crore as other income, largely from the sale of investments and participation in subsidiary share buybacks.

- Other income in FY24 saw a dramatic rise from ₹171 crore in FY23.

📈 Tata Sons Dividend Income FY25: Subsidiary Breakdown

| Subsidiary | Tata Sons Stake (%) | Dividend/Share (₹) | Income Received (₹ Cr) |

|---|---|---|---|

| TCS | 71.7 | 130.0 | 33,743.0 |

| Tata Steel | 31.8 | 3.6 | 1,427.7 |

| Tata Motors | 40.2 | 6.0 | 887.0 |

| Tata Power | 45.2 | 2.0 | 289.0 |

| Tata Consumer | 28.7 | 7.8 | 220.0 |

| Tata Elxsi | 42.2 | 70.0 | 184.1 |

| Indian Hotels | 35.7 | 1.8 | 88.8 |

| Tata Chemicals | 31.9 | 15.0 | 121.9 |

| Tata Communications | 14.1 | 16.7 | 67.0 |

| Tata Investment | 68.5 | 28.0 | 97.1 |

| Voltas | 26.6 | 5.5 | 48.5 |

| Trent | 32.5 | 3.2 | 36.9 |

| Titan | 20.8 | 11.0 | 2.0 |

Total Expected Dividend Income in FY25: ₹37,212 crore

📌 Tata Capital IPO & Regulatory Compliance

The board is also likely to discuss progress on the Tata Capital IPO, which has been filed confidentially with SEBI. Tata Capital is classified as an upper layer NBFC, and under RBI norms, must list on the stock exchanges by September 2025.

Additionally, Tata Sons itself, classified under the same upper-layer NBFC category, is under pressure to list. The company has taken measures in recent years to reduce its debt and exposure to financial subsidiaries, possibly paving the way for a regulatory reclassification.

On May 8, 2025, following NCLT approval, Tata Motors Finance was officially merged into Tata Capital, streamlining the group’s finance operations.

📅 What to Expect From the Upcoming Tata Sons Board Meeting:

- Approval of FY25 balance sheet and P&L statements

- Review of dividend distribution to Tata Trusts and preference shareholders

- Strategic discussions on ongoing investments including semiconductor and EV battery initiatives

- Evaluation of Tata Capital IPO timeline and compliance milestones